Created by We4bs.

RACS International, LLC

“RACS” hereafter

Contact Info

Contact Info

Copyright © 2017 RACS International, LLC

All rights reserved.

\\ About Us

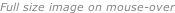

RACS can be best described by the views predicating the design and implementation of its products and services.

- Decision making or execution algorithms are not the products sought out by investors but are merely quantitative sequences of automated instructions designated to meet their users’ objectives;

- For these algorithms to be persuasive, they should answer the questions on what objective they meet, why they meet that objective, why they meet that objective optimally, and how their logistic design and deployment environment supports the addressing of the previous three questions and enables efficient deployment.

Decision making algorithms not products in and of themselves

Prediction / forecasting vs. learning

- Predicting or forecasting the future is the prerogative of prophets and not one of RACS;

- Instead, analytics designated for big-

data induced environments, incorporating an embedded low- latency feedback control mechanism, offers definition and implementation of enhanced with learning capacity algorithmic behavioral strategies, adaptable under the streaming reality.

- Even a hypothetically perfect and one-

of- a- kind decision making algorithm suited to a particular strategy does not necessarily imply that distinct clients will demonstrate identical performance; - Due to the differences in risk and capital allocation policies of different clients, including of their complementary portfolios, and the asynchronicity of submitted orders, the same algorithms may not always lead to the same outcome;

- Differences may also result from the departure of the evolution of these portfolios at some future moment throughout the life of the given algorithm;

- If the two executions of the same algorithm do not depart during its lifetime, it only means that the market can sustain identical executions of the same strategy by both agents.

Contrary to the opinions held in and around industry

- Being also dismissive of the traditional efficient markets hypothesis, whichever form it may be stated in, and finding that this hypothesis is not only not true but also is not the proper nomenclature for trading and asset management rationalization, RACS believes that, except miraculously, no trader or asset manager acts on an individual level optimally within the context of his/her own strategies, though the deviation of their execution from optimality may most frequently be small;

- RACS technology’s ability to capture and monetize this non-

optimality is what creates excess- over- the- equilibrium- value for its clientele.

Markets are not efficient and not optimal

Finally, RACS departs from an understanding that the best and most optimal decision making algorithm doesn’t necessarily result in profitable performance. This is a market reality rather than an optimal decision making algorithm deficiency.

“Asset allocation and buying behavior changes: Further implementation of outcome-

eVestment February 2014 survey

Technology’s applicability beyond the financial industry

- RACS algorithmic decision making technology is applicable to other data-

intensive competitive- cooperative decision- making industries.