Created by We4bs.

RACS International, LLC

“RACS” hereafter

Contact Info

Copyright © 2017 RACS International, LLC

All rights reserved.

Financial Market \\ Market

Target market

RACS target market includes:

- 11,000+ hedge funds, proprietary trading houses, Commodity Trading Advisers (CTAs), asset management companies; funds of funds, pension, sovereign funds, university endowments and similar upstream investment organizations;

- Of these, 7,524 are traditional hedge funds, 1,723 – managed futures or CTAs and 2,074 funds of hedge funds. They are managed by more than 4,500+ separate firms;

- Quant departments of not falling under the Volcker rule corporate and investment banks, and broker-

dealers.

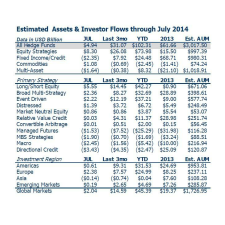

Market size estimates

- Based on public information and RACS in-

house estimates, the gross market value of the global hedge fund, managed accounts, investment and commercial bank trading industries is well in excess of $3 trillion/year; - Based on the standard compensation structure of these organizations consisting of or equivalent to the amount equaling to the 2% of the invested capital and 20% carry of the generated profits, and based on various assumptions in the range from conservative to aggressive, one can estimate the market share allocated to the in-

house decision making technology providers to be $7- 15 billion a year.

“Successful asset managers will adapt to changing demand drivers by: Segmenting clients in order to properly position products against desired outcomes.”

eVestment February 2014 survey